We saw quite a bit about Bitcoin, a digital cryptocurrency, in the news during the second half of last year. We are seeing property transactions in Australia being offered with this currency as well. This article takes a look at the relationship of them.

History

If you haven’t entered the world of cryptocurrency, it can be a bit confusing. Bitcoin is a digital currency which is offered worldwide. It is traded through exchanges, rather than the traditional banking sector. From the exchange the seller can accept payment as bitcoin or as their local currency.

It was first introduced in 2009 but has gained momentum in value in recent times.

There are certainly risks and advantages for Bitcoin, and we have linked to some articles in Further Reading which outline some of these. If you are planning on stepping into the CryptoCurrency world, you certainly need to complete your due diligence, as with any currency or investment opportunity or financial transaction.

Purchasing Power

Although the number of vendors accepting bitcoin as payment is still fairly limited, the variety of goods available for purchase with cryptocurrency is still growing. There are over 100,000 sellers worldwide. As many of these are online, it means the purchases are available practically anywhere as well.

A quick online search will discover you can purchase items such as Cars, property, coffee, even uber rides with Bitcoin. There is even a credit card available to facilitate the transactions. Want to buy a beer with Bitcoin? Check out the Old Fitzroy hotel in Sydney, one of the first pubs to accept Bitcoin as payment.

Property

Property has been offered for purchase by Bitcoin in Australia since at least 2014, and there are a couple of properties around the states that are offering full or part payment in BitCoin in more recent times. There doesn’t appear to have been a complete transaction finalised at this time, so we will watch in anticipation to see how it progresses.

In the US there have been a couple of property transactions completed with Bitcoin. One of the first transactions in Lake Tahoe, US, in 2014, and earlier this year – Austin Texas US.

Taxes and stamp duties are still applicable, so these will need to be paid in Australian Currency, but, for those who are familiar and comfortable with the CryptoCurrency, it can certainly be a way to open up to additional buyers, especially in a slow market, giving the seller an advantage over their competition.

In fact, Kathleen Elkin, CNBC, states that all you need is an agreement between the buyer and seller to perform the transaction in CryptoCurrency. There is even a dedicated online Bitcoin Property real estate which lists properties all over the world!

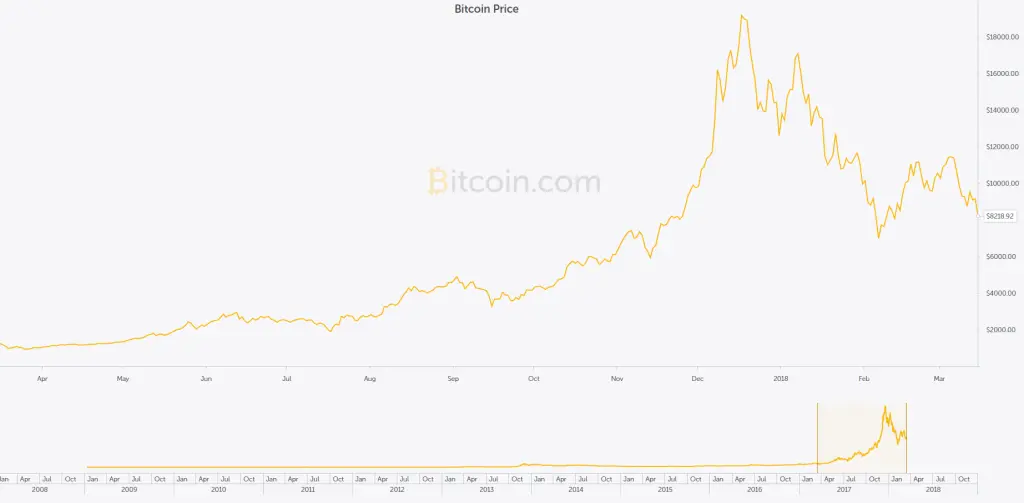

Like any trading commodity, the value of cryptocurrency fluctuates. This graph of BitCoin shows that, although there has been a correction since the excitement of last year, it is still higher than a the 2008-2014 period. Source: https://charts.bitcoin.com/chart/price

Australian Accounting

From an Australian point of view, the ATO is constantly monitoring transactions to ensure that tax obligations are being met. Carrington Clarke, abc.net.au, states: “Legislation has passed Parliament that will force cryptocurrency exchanges to disclose details of investors and transactions.

Australia’s financial crime fighting agency AUSTRAC will be tasked with keeping an eye on trading to try to stop cryptocurrencies from being used for money laundering and financing terrorism.” Australia is following Japan’s lead to regulate cryptocurrency.

Rae Johnston, Gizmodo.com.au, reports that, although the ATO is currently conducting external consultations to ensure its own processes are correct, “The ATO says there won’t be income tax or GST implications “if you are not in business or carrying on an enterprise and you simply pay for goods or services in Bitcoin [or other cryptocurrency].”

Alternative Transactions

On reflection, offering or accepting Bitcoin as a form of payment for Property is not that far removed from other “alternative transactions”. Vendor Finance, Barter or Partial Goods Trade have been conducted on a fairly frequent basis for many years. These style of transactions do not form the majority, and neither will CryptoCurrency in the foreseeable future. In the longer term though? Who knows. After all, our grandparents didn’t have mobile phones!

FURTHER READING

http://onproperty.com.au/buy-a-house-using-bitcoin/

https://www.cnet.com/pictures/25-things-you-didnt-know-you-could-buy-with-bitcoins/

https://www.cnbc.com/2017/10/16/bitcoin-is-finally-buying-into-us-real-estate.html

https://www.cnbc.com/2018/01/03/heres-the-one-thing-you-need-to-buy-a-house-with-bitcoin.html

https://www.gizmodo.com.au/2018/01/the-ato-is-after-your-sweet-sweet-cryptocurrency-tax-dollars/

http://www.abc.net.au/news/2018-01-17/bitcoin-and-other-cryptocurrencies-tumble/9335774

DISCLAIMER – Alleura recommends each individual seek the services of a qualified service provider before undertaking any financial investment. The information provided here is for general information purposes only. It is not intended as financial or investment advice.